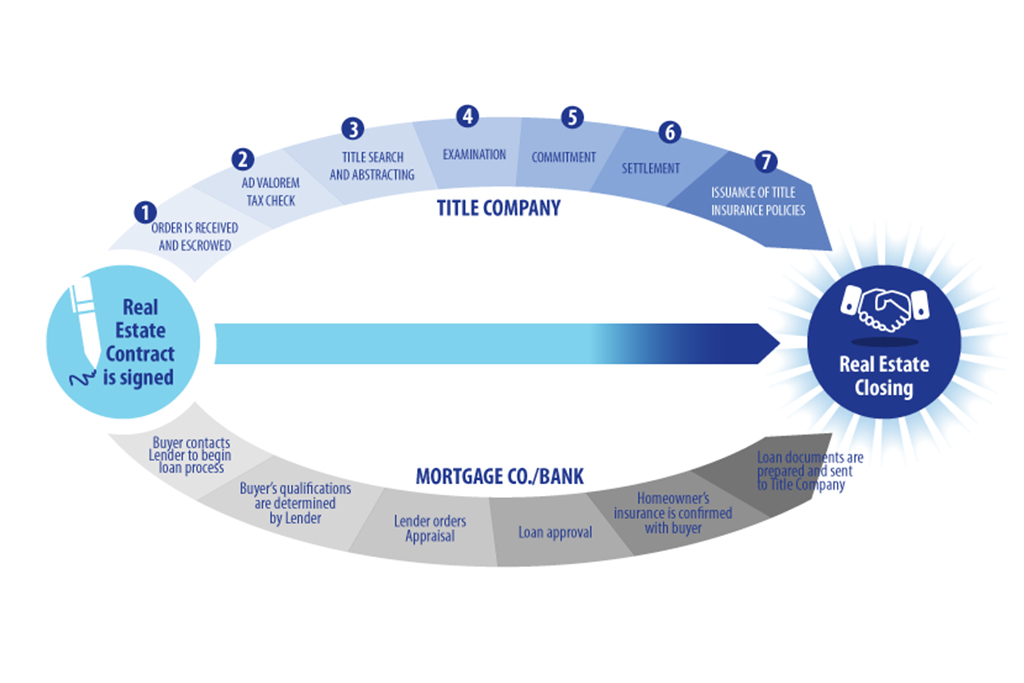

What Do Title Companies Do?

There are six steps that take place when transferring a land title. It is the title company’s job to manage the six step process:

Step 1: The order is received

The process begins when the title company receives a real estate earnest money contract, or agreement to close. The contract is “receipted” by the title company, which includes acknowledging receipt of the contract and any earnest money received. An escrow account is then set up on your behalf and the earnest money is deposited for holding until the closing.

Step 2: Ad Valorem Tax Check

Step 3: Title Search and Abstracting

Step 4: Examination

The examiner then identifies the current legal owner and any debts owed on the property by following the flow of ownership evidenced in the documents gathered by the abstractor. In order for the title company to insure the new buyer as the only claim to ownership, the examiner must confirm each previous transfer was handled correctly and legally.

Step 5: Commitment

Step 6: Settlement

The desired event for the seller and buyer is to “close” the transaction. This involves the escrow officer bringing together all the involved parties and overseeing the execution of the documents necessary to facilitate the sale, such as the deed, new mortgage, etc.. The title company will facilitate recording of all recordable documents and then disburse money to the parties who will receive funds. After closing, the terms of the contract are typically fulfilled and the transaction is complete.

Step 7: Issuance of the Title Insurance Policies

After the transaction has closed and funded and the documents have been recorded at the courthouse, the title company issues the title insurance policy. The owner policy of title insurance is issued to the buyer, and the mortgagee policy of title insurance is issued to the lender. This is all done in accordance with the terms and conditions of the commitment for title insurance.